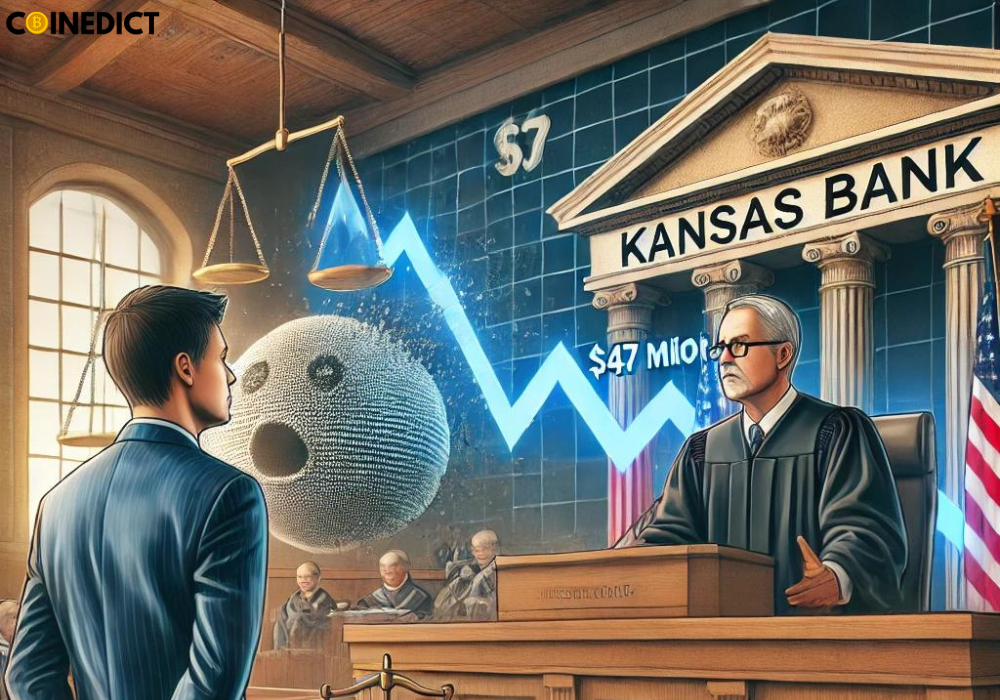

In a case that underscores the growing intersection of traditional finance and cryptocurrency, a former Kansas bank chief executive has been sentenced to over 24 years in prison for orchestrating a $47 million embezzlement scheme involving cryptocurrency, which ultimately led to the collapse of the bank he once led. The sentencing marks the culmination of a high-profile case that has sent shockwaves through the financial community, highlighting the potential risks associated with the misuse of digital assets.

The Embezzlement Scheme

The case revolves around the actions of the former bank CEO, who used his position to siphon off millions of dollars from the bank’s reserves. Over several years, the executive diverted funds into various cryptocurrency investments, using complex and opaque financial transactions to cover his tracks. The fraudulent activities were concealed through falsified records and deceptive accounting practices, making it difficult for auditors and regulators to detect the ongoing theft.

According to court documents, the executive initially presented his cryptocurrency investments as a legitimate opportunity for the bank to diversify its portfolio and increase profits. However, these investments were not authorized by the bank’s board, and the CEO acted without proper oversight. The funds were funneled into speculative and highly volatile crypto assets, many of which were poorly understood or outright fraudulent.

As the value of these cryptocurrency investments plummeted, the bank began to experience severe financial strain. The losses mounted, and the bank was eventually unable to meet its financial obligations, leading to its collapse. The collapse left depositors, investors, and employees devastated, with many losing significant portions of their savings and pensions.

The Legal Proceedings

The investigation into the embezzlement scheme was initiated after the bank’s sudden collapse triggered alarms among federal regulators. A thorough audit revealed the extensive fraud, leading to the arrest of the former CEO. During the trial, prosecutors presented evidence showing how the executive had abused his position of trust to systematically drain the bank’s resources for personal gain.

The court heard testimonies from former employees, financial experts, and victims of the fraud, all of whom painted a picture of a bank executive driven by greed and reckless ambition. The prosecution argued that the defendant’s actions were not only illegal but also showed a blatant disregard for the bank’s customers and the wider community.

In handing down the sentence, the judge emphasized the severity of the crime and its far-reaching consequences. The 24-year sentence reflects the court’s view that the defendant’s actions were particularly egregious, given his role as the leader of a financial institution entrusted with safeguarding the assets of others.

The Collapse of the Bank

The collapse of the Kansas bank had a profound impact on the local community and the broader financial system. The bank, once a trusted institution with deep roots in the region, was forced into bankruptcy, resulting in significant losses for its depositors and investors. Many local businesses that relied on the bank for financing were also affected, leading to job losses and economic hardship in the area.

Federal regulators were quick to step in, initiating a broader investigation into the circumstances surrounding the bank’s failure. The case has prompted calls for stricter oversight of banks’ involvement in cryptocurrency investments, with many experts warning that the lack of regulation in this area poses significant risks to the stability of the financial system.

Implications for the Financial Industry

The sentencing of the former Kansas bank CEO serves as a cautionary tale for the financial industry, particularly as more institutions explore the potential of cryptocurrency. While digital assets offer exciting opportunities for innovation and growth, this case highlights the dangers of unchecked speculation and the importance of robust oversight and regulation.

The case also raises questions about the role of bank executives and the need for stronger governance structures to prevent similar abuses of power. As the financial industry continues to evolve, it is clear that traditional safeguards must be adapted to address the unique challenges posed by cryptocurrency and other emerging technologies.

Conclusion

The 24-year prison sentence handed down to the former Kansas bank CEO marks the end of a tragic chapter in the bank’s history, but it also serves as a stark reminder of the potential pitfalls in the rapidly changing financial landscape. The case underscores the need for greater vigilance and accountability in the management of financial institutions, especially as they increasingly engage with the complex world of cryptocurrency. For the victims of the fraud, the sentence offers some measure of justice, though the damage inflicted on the community and the financial system will be felt for years to come.