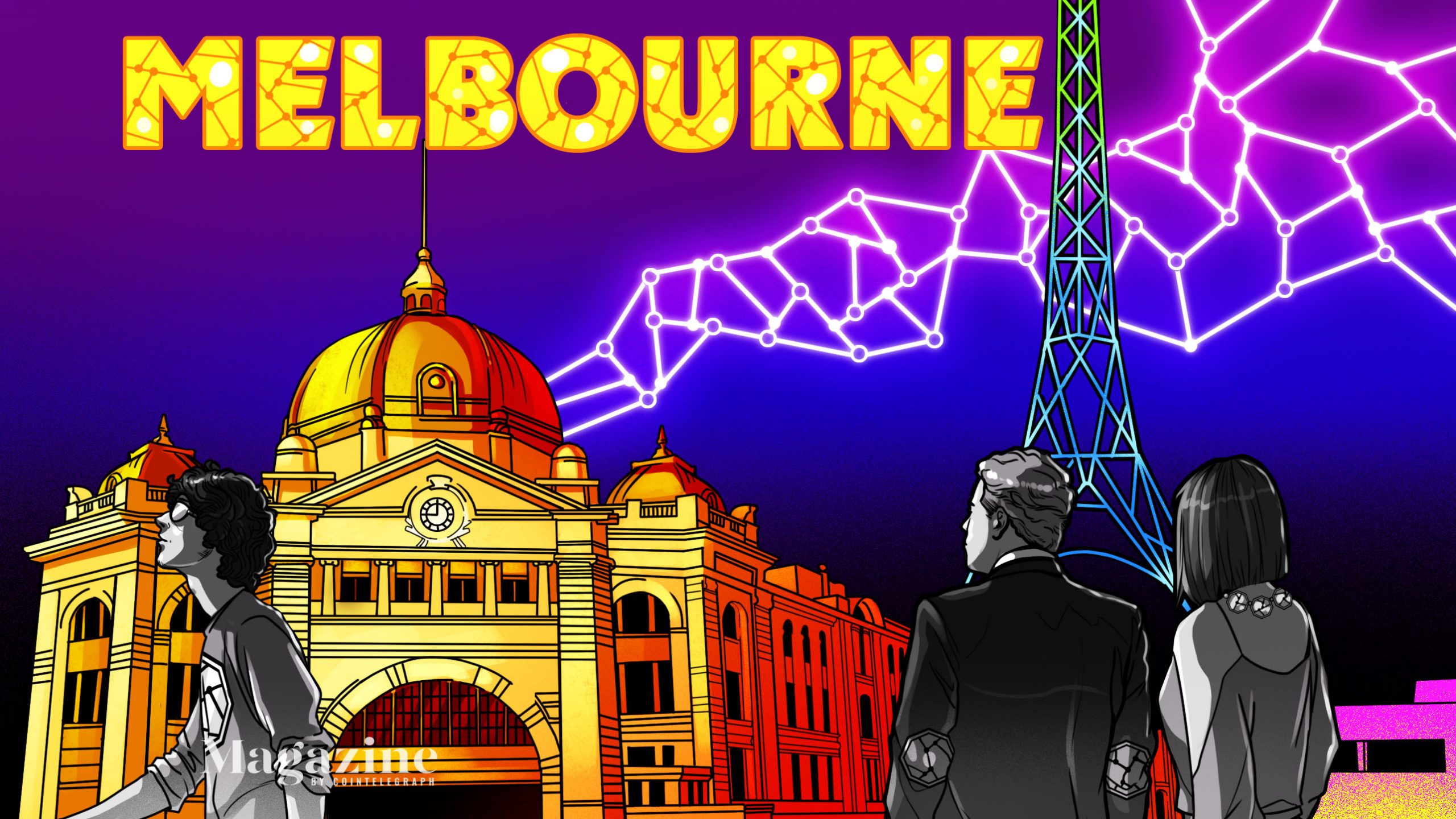

Guide to Melbourne – Cointelegraph Magazine

This “Crypto City” guide looks at Melbourne’s crypto culture, the city’s most notable projects and people, its financial infrastructure, which retailers accept crypto and where you can find blockchain education courses — and there’s even a short history with all the juicy details of famous controversies and collapses. Fast factsCity: MelbourneCountry: AustraliaPopulation: 5.15MEstablished: 1835Language: English Australia’s second-largest city may lack Sydney’s amazing harbor views, but it makes up for it with a focus on art, sports and culture. There are more live music venues here per capita than any other city in the world, and the city has produced heaps of notable acts, including Nick Cave, Men at Work, The Avalanches and Kylie Minogue.Located on the southern coast of Australia, Melbourne wasn’t founded until almost 50 years after Sydney, but it quickly became the wealthiest place in the world during the Gold Rush, from the 1850s to 1880s. It’s a very multicultural city, with the 10th-largest immigrant population globally. The city also ranks at number 27 on the Global Financial Centers Index and is home to the Australian Rules football code, the Australian Grand Prix and the Australian Open. It was the filming location for the first Mad Max film alongside Chopper and Animal Kingdom. Politically, Melbourne is more left-wing than any other city in the country and is home to the union movement. The Yarra River in Melbourne. Source: Pexels Crypto cultureMelbourne embraced cryptocurrencies early on, and a thriving community was built up through regular meetups including Blockchain Melbourne, Women in Blockchain, Web3 Melbourne and futureAUS. Karen Cohen, deputy chairperson of Blockchain Australia, recalls there being a huge influx of newcomers during the ICO boom in 2017.“The meetup culture was really exciting. We couldn’t get enough space, so people were watching our meetups on Facebook Live because they couldn’t get into the room because it was so busy.”Talk & Trade meetups were held every Wednesday from 2015 to 2019 at the Blockchain Centre. Located at the Victorian Innovation Hub in the docklands, the Blockchain Centre was the heart of the community in real life, at least until the coronavirus pandemic struck.Melbourne has been home to numerous crypto exchanges since 2013, and a plethora of ICOs were also founded in the city in 2017 and 2018, including CanYa, which operates freelancer platform CanWork, and blockchain voting company Horizon State.While the pandemic has moved most things online for the past 18 months, Blockchain Australia hosted a series of events at YBF Ventures in the Melbourne central business district (CBD) for the national Blockchain Week earlier this year, and Talk & Trade is now held at RMIT, in between lockdowns.With live events beginning to reemerge as vaccine rates slowly grind up, YBF Ventures will relaunch its blockchain community meetups, supported by Cohen as the expert in residence for blockchain. “2020, sadly, has been hard with COVID, so it’s had to move online,” she says. “But I think if we were able to meet in real life, it would still have very much a meetup culture.” Melbourne has the largest tram network in the world. Source: PexelsProjects and companiesMelbournites appear very interested in solving the problem of interblockchain communication, with at least three major cross-chain projects having strong ties to the city. CanYa founder JP Thor helped found the cross-chain decentralized liquidity protocol THORChain, and some of the anonymous local devs from THORChain went on to work on a similar project called Sifchain. Melbourne’s Simon Harman founded another cross-chain automated market maker, Chainflip, along with the privacy project Loki, which is now known as Oxen.Web 3.0 developer studios Flex Dapps and TypeHuman are located here, as is the white-label blockchain services provider Pellar, whose infrastructure processes 10 million requests a day from around the world. Researchers from the government-run Commonwealth Scientific and Industrial Research Organisation and Monash University invented the MatRiCT technology (licensed to Hcash), which protects crypto from being cracked by quantum computers. NFT digital racehorse game Zed Run just raised $20 million from investors including TCG and Andreessen Horowitz. Algorand also has a noticeable presence in Melbourne, including through the Meld gold platform and Algomint. Dear Elon,Best regards.Chris Hemsworth, @THORChain CEO, 2021 pic.twitter.com/4MDli8anpW— Fede