Mango Network: A Transactional Omni-Chain Backbone Leads Omni-Chain Evolution in 2024

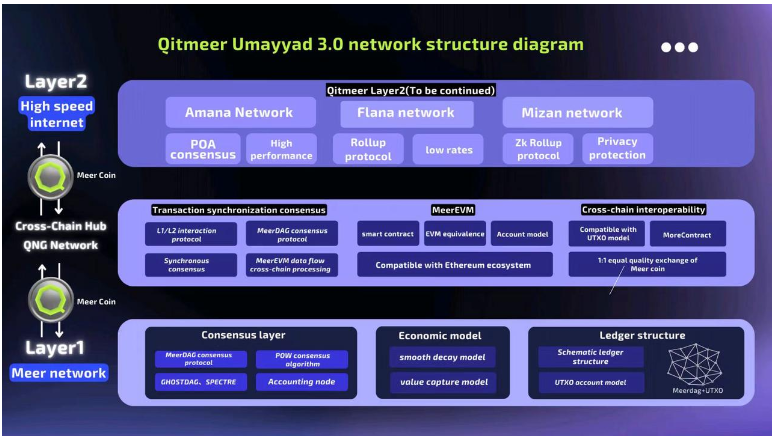

In 2024, the blockchain industry is experiencing a new paradigm shift, and Omni-chain narrative is becoming the industry theme. Mango Network ($MGO), as the industry’s first Layer1 new public chain positioned to become a transactional omni-chain backbone network, is leading a new round of innovation in the DeFi field, with its unique advantages of high performance and modularity, as well as the concept of omni-chain liquidity pool. Mango public chain is coming soon, enabling seamless transfer of tokens, NFTs, data and information between heterogeneous L1/L2 public chains. The fragmented crypto assets and liquidity mining pools of different chains achieve efficient Omni-chain circulation through Mango. Mango’s Omni-chain application gives birth to an omni-chain liquidity pool, providing new possibilities for Web3 and DeFi innovation. In 2023, the global blockchain landscape saw a shift from bear to bull market. The year’s stories included the rise of Layer 2 networks, the launch of new public chains backed by Move language, the cross-chain competition led by LayerZero, and the breakout of the BRC20 inscription MEME tokens. As more users entered the space and the industry’s ecosystem of use cases expanded, multi-chain users increasingly demanded seamless cross-chain interaction. On the other hand, the industry as a whole began to realize that building an omni-chain infrastructure is the most direct and effective way to break the blockchain trilemma. The omni-chain narrative is becoming the industry’s theme, leading to a new round of paradigm shifts in 2024. In the face of industry pain points, Mango Network ($MGO) takes the lead and becomes the industry’s first Layer1 new public chain positioned as a transactional omni-chain infrastructure network. By building an all-in-one liquidity service omni-chain network, it brings users a more secure, trustworthy, asset-diverse, and convenient self-governing omni-chain trading experience. Move-based and inherently safe More than just a programming language for crypto assets, the Move language is a valuable legacy of Facebook’s super-sovereign cryptocurrency project Libra, which bridges the gap between Solidity and EVM and offers a high-performance, secure, and reliable smart contract programming environment for blockchain applications. Mango Move is a statically typed programming language with multi-threading capabilities that can effectively reduce concurrency situations. The combination of a static language with smart contracts provides a secure environment for application development, where the project source code is not tampered with in the event of an attack. Moreover, the Move language treats digital assets as first-class citizens, specifically defining Token as an independent resource category (Resource) to distinguish it from other data. The asset transfer of Mango Move is object transfer, ensuring the uniqueness and security of assets, and adding more security for on-chain DeFi projects. Modularity leads to high performance, breaking the impossible triangle Based on the Mango Move language, the Mango modular blockchain decomposes blockchain functionality into different levels of network architecture, achieving high security, high performance, and low cost, and breaking the “impossible triangle” of decentralized networks. Traditional blockchain systems usually integrate functions such as consensus, settlement, data availability, and execution in a single architecture, which will not be able to meet the requirements of different scenarios as the complexity and demands of blockchain applications increase. The Mango modular blockchain separates these core functions so that individual functional modules can operate independently while maintaining collaboration with each other. This architecture makes the blockchain system more flexible and scalable, allowing for customization and optimization based on different needs. Through features such as horizontal scalability, composability, and on-chain storage, Mango Network can achieve over 100,000 TPS of parallel transaction processing and sub-second settlement. It also supports a wide range of on-chain assets and solves the common pain points of L1 with unparalleled speed and low cost, bringing developers and users an amazing user experience. Born as an omni-chain, pioneering new paradigms for applications As a L1 public chain positioned as enabling omni-chain application, Mango’s biggest advantage is that it can serve as an efficient execution layer and settlement layer, allowing developers to design applications from the perspective of omni-chain interoperability. Users can interactive with on-chain applications through any L1 and L2 chains, significantly reducing the complexity of user operations. The technical architecture of Mango’s omni-chain application consists of Mango main chain contracts and module contracts. The main logic of the application is stored in the Mango main chain, implementing “central control”. Then, remote access modules are deployed on other chains to interact with end users, obtain user input, and output the desired results. For example, DEX developers can deploy dApps on the Mango main chain. Users can operate the application from the Mango main chain and also perform operations on any other chain through remote access modules, just as convenient as accessing local programs. This also means that users only need to prepare one kind of Token as Gas, and do not need to know which chain the dApp is actually deployed on, in order to realize any cross-chain operations. The biggest advantage of Mango’s omni-chain application technology architecture is that it significantly reduces the complexity of cross-chain integration. When the main logic of the program is processed on the Mango main chain, the application has a unified state record. After the user deploys the contract on a new chain, they can inherit all the state records and liquidity from the main chain of the entire network. Meanwhile, when other applications integrate this program, they only need to connect on the main chain to access all its features and liquidity. Compared to cross-chain protocols like LayerZero, Mango’s omni-chain application does not require frequent asset cross-chain operations between different blockchains, resulting in lower costs, faster confirmations, and higher efficiency. At the same time, the omni-chain transaction does not require storing assets or data in a third-party institution, thus ensuring a higher level of asset security. The omni-chain application realizes the perfect connection of heterogeneous blockchains, solves the multiple pain points of Web3 application and DeFi protocols, such as user experience and liquidity fragmentation, and builds a one-stop liquidity service network through the main-chain contract and modular contract, delivering a unique…