While Bitcoin is expected to be profitable in 2024, many mining stocks are continuing to record losses this year.

Bitcoin fell to $96,255 on December 24, with a 2024 return of 113%, but most mining stocks managed to boost the cryptocurrency’s profits and ended in the red.

According to data from Hashrate Index and Google Finance, the majority of registered miners will end 2024 in negative territory, with losses reaching 84%.

Of the 25 mining companies listed in the index, only seven have made a profit for investors this year. At the time of writing, Bitdeer (BTDR) is up 167%, Cipher (CIFR) is up 33%, Hut 8 (HUT) is up 91%, Iris Energy (IREN) is up 72%, Northern Data (NB2) is up 58%, Core Scientific (CORZQ) is up 327% and TeraWulf (WULF) is up 169%.

On the other hand, Argo Blockchain (ARB) is down 84%, Sphere 3D (ANY) is down 69%, MARA Holdings (MARA) is down 12%, Hive (HIVE) is down 29%, and Greenidge (GREE) is down 74%. For example, Bitfarms (BITF) fell 44% and BitFufu (FUFU) fell 18%.

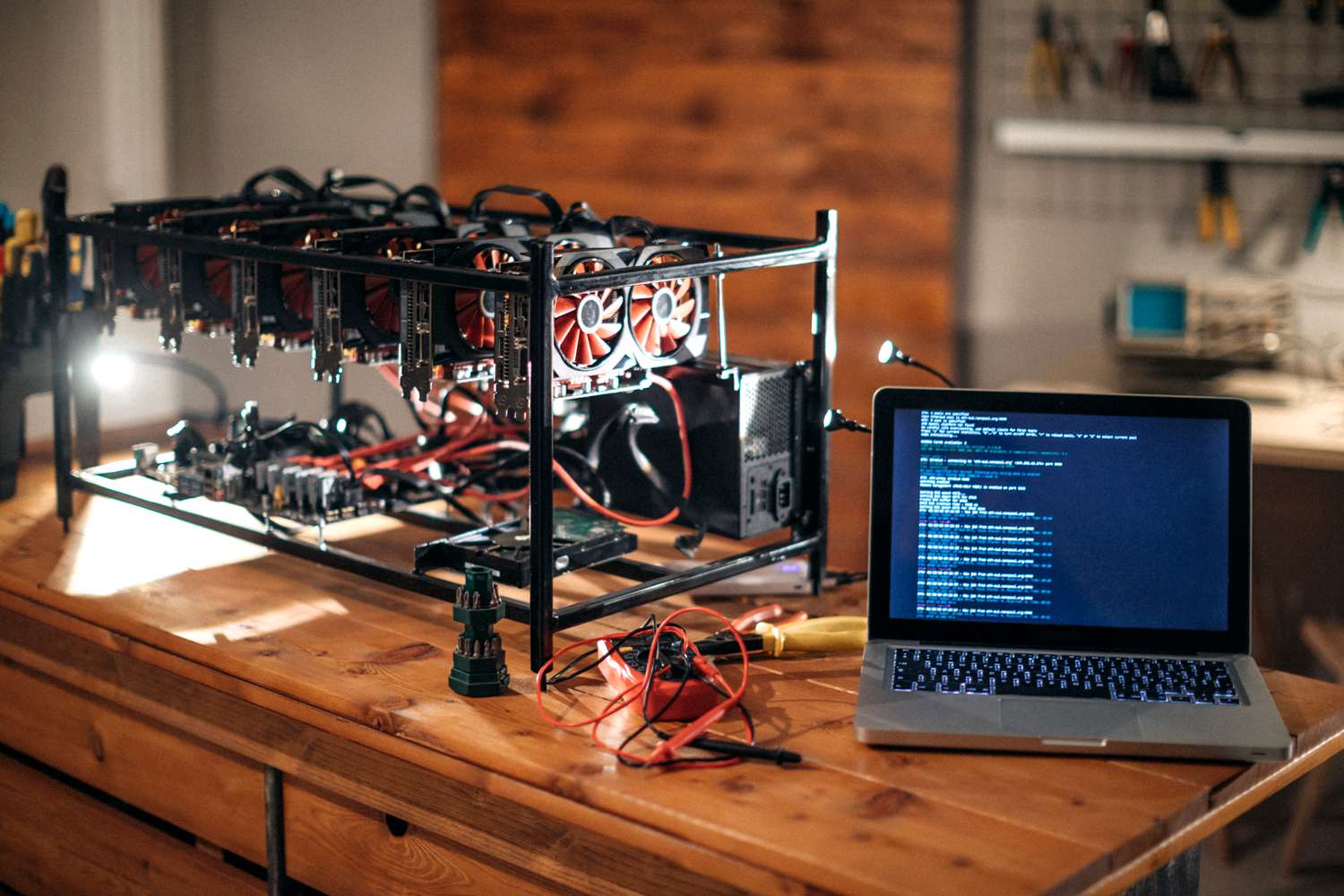

Challenges facing miners in 2024

Overall, 2024 will be a year of adjustment for Bitcoin mining companies as they deal with falling prices and rising costs and find new sources of revenue to stay afloat.

Miners have earned more than $71 billion since the network’s inception, but every four years, their income from mining new blocks is cut in half during a halving event. The most recent Bitcoin halving occurred in April, reducing the mining fee from 6.25 BTC to 3.125 BTC. According to Blockchain.com, mining revenue was $42 million as of December 22, down from a peak of $100 million in April.

At the same time, the difficulty of creating a new block on the Bitcoin blockchain has doubled compared to last year, fueling the increasing costs of Bitcoin mining. Bitcoin’s average difficulty is currently 108.52, up from 72.01 last year and up 50.71% over the past 12 months.

Mining costs have also risen sharply due to the increase in costs. For example, BitFuFu reported that Bitcoin mining costs increased by 168% to $51,887 per BTC, while mining power increased by 62.5%.

In order to increase their financial position, many listed mining companies have turned to the capital markets.

Nine of the 13 Bitcoin mining companies listed in the US raised a total of $1.25 billion through share offerings in the second quarter. This trend continued in the third quarter, with an additional $530 million raised, bringing the total to $2.2 billion.

In addition, many companies are looking to transform their operations by 2024. Bitcoin mining firm Core Scientific has entered the artificial intelligence space by partnering with CoreWeave to host Nvidia GPUs, aiming to meet the growing demand for intelligent computing power. The partnership will bring Core Scientific $8.7 billion in revenue over the next 12 years.

Some mining companies are following the lead of publicly traded companies and using Bitcoin reserves to bolster their portfolios. The latest in this trend include MARA and Hut 8.