Headlines

Latest News

Bitcoin News

Bitcoin (BTC)

1h0.00%

24h4.14%

USD

EUR

GBP

- All Posts

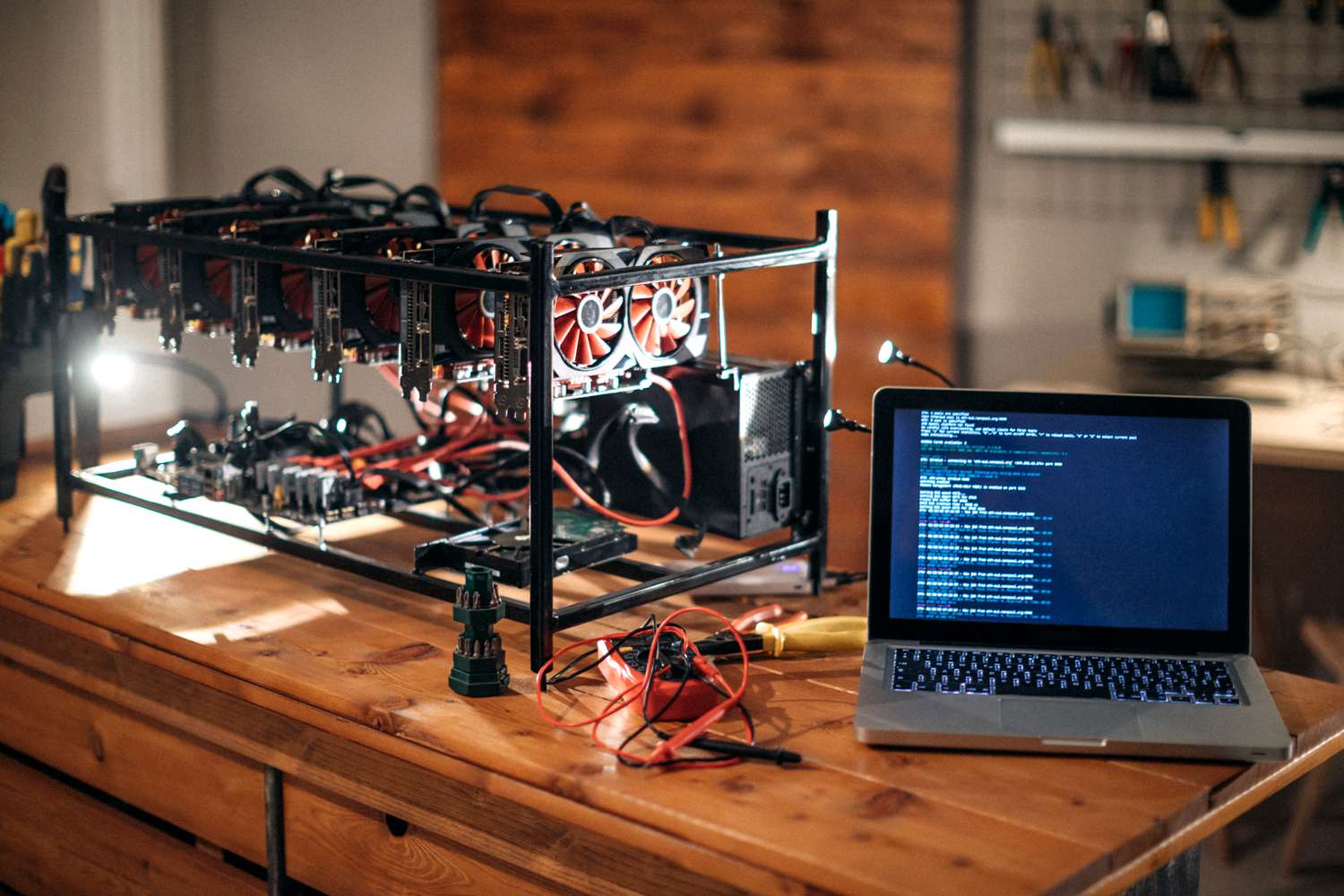

- Bitcoin

- Blockchain

- Crypto

- Defi

- Ethereum

- Guest Post

- Metaverse

- News

- NFT

- PR

- PR Wire

- Press release

- Review

- Web 3.0