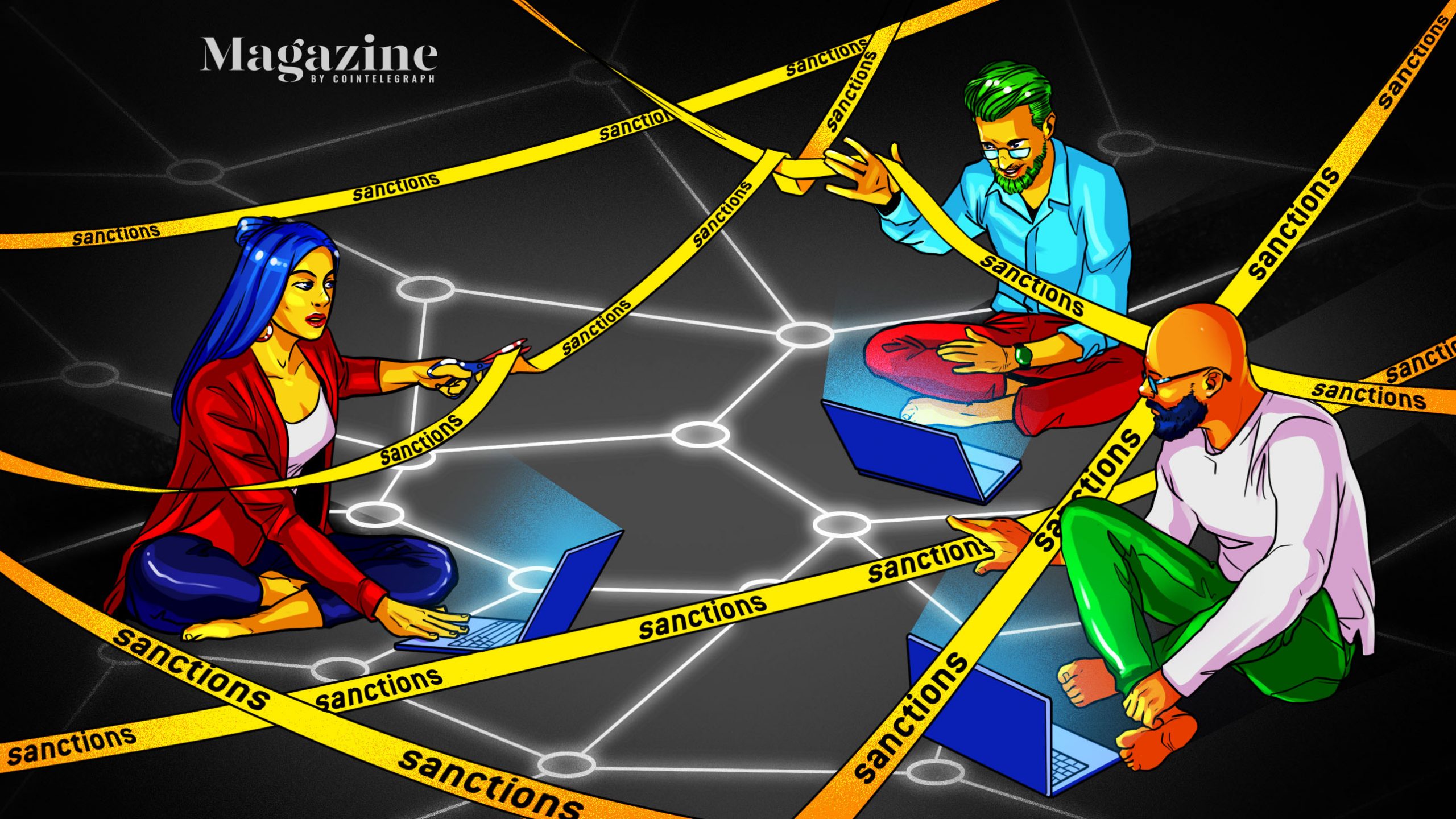

When the United States first began going after crypto companies for violating its economic sanctions rules, it didn’t exactly start with a bang.In December, the Treasury Department’s Office of Foreign Assets Control (OFAC) announced a settlement with crypto wallet provider BitGo after the Palo Alto firm failed to prevent persons apparently located in the Crimea region, Iran, Sudan, Cuba and Syria “from using its non-custodial secure digital wallet management service.” The penalty for the “183 apparent violations” of U.S. sanctions? An underwhelming $98,830. This was “the first published OFAC enforcement action against a business in the blockchain industry,” according to law firm Steptoe, though six weeks later, the OFAC reached a similar settlement with BitPay, a payment processing firm, for 2,102 “apparent violations of multiple sanctions programs,” in which BitPay reportedly allowed persons in the same countries as in the BitGo case — but with the addition of North Korea — “to transact with merchants in the United States and elsewhere using digital currency on BitPay’s platform even though BitPay had location information, including Internet Protocol addresses and other location data, about those persons prior to effecting the transactions.” BitPay agreed to pay $507,375 to resolve its potential civil liability. But future violators may not be treated so leniently. It’s worth mentioning that economic sanctions are typically applied “against countries and groups of individuals, such as terrorists and narcotics traffickers,” according to the United States Treasury, typically “using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals.”More enforcement actions are coming“The crypto industry should absolutely expect more enforcement actions from OFAC, and it can expect that there will be much larger penalties as well,” David Carlisle, director of policy and regulatory affairs at Elliptic, tells Magazine. “OFAC’s first two enforcement actions in this space were fairly simple cases, where the underlying violations were not egregious, and the fines were small. But the next cases could be different,” he says, adding:“There will undoubtedly be other cases out there that involve much more serious and egregious violations — and we can expect that OFAC will issue fines against crypto businesses that are much larger than those we’ve seen thus far.” Expect more enforcement actions like those targeting BitPay and BitGo, Doug McCalmont, founder of BlocAlt Consulting LLC, tells Magazine, as well as “the expansion of targeted individuals, such as coders linked to the technology.”Sanctions regimes have been applied extensively in recent years by the United States, as well as the European Union and United Nations, often targeting “rogue” nation-states, such as North Korea and Iran. One of the best-known early crypto cases involved Virgil Griffith, a former hacker, who was arrested in April 2019 after he spoke at a blockchain and cryptocurrency conference in North Korea, in violation of sanctions against that outcast nation, the U.S. charged.“Sanctions violations are a real problem,” says David Jevans, CEO of CipherTrace, whose crypto forensics firm recently found that more than 72,000 unique Iranian IP addresses are linked to more than 4.5 million unique Bitcoin addresses, “suggesting that sanction violations are likely rampant and mostly undetected by virtual asset service providers,” he tells Magazine. It’s not only U.S. authorities who are concerned about “bad actors” using the nascent blockchain technology to dodge economic sanctions. Agata Ferreira, assistant professor at the Warsaw University of Technology, tells Magazine that authorities in Europe “are becoming more active and more focused. The crypto space is under increasing scrutiny, and I do think this trend will remain and accelerate.”Nor is OFAC’s recent crypto focus surprising, according to Robert A. Schwinger, partner in the commercial litigation group at Norton Rose Fulbright. The United States government has no choice but to rein in this new, cryptocurrency asset class because “not to do so would expose it to the risk that its sanctions regime could be rendered toothless by new financial technology. Players in the cryptocurrency space who ignore the restrictions imposed by U.S. international sanctions are being put on notice that they do so at their peril,” he wrote on Law.com. Is DeFi problematic?As crypto adoption grows, it seems only inevitable that its decentralized finance (DeFi) networks will push up against more nation-state prerogatives, including economic sanctions. But isn’t there something inherently problematic about cracking down on a decentralized exchange (DEX)? Does the exchange even have a headquarters address? Is anyone even home at home? And should it even answer to someone if it’s truly decentralized?Enforcing regulations in a decentralized world presents certain challenges, Timothy Massad, former chairman of the U.S. Commodity Futures Trading Commission and now a senior fellow at Harvard University Kennedy School, tells Magazine, but U.S. regulators are “trying to figure it out.” Might the government eventually put more pressure on developers at DeFi firms, including decentralized exchanges? “Yes, they can build into the code some proper procedures… but it’s a lot easier to go after centralized intermediaries,” says Massad.“I think we’ll see DeFi developers come under real pressure to ensure their platforms can’t be abused for sanctions evasion — for example, by enforcing address blacklisting,” says Carlisle, adding, “There’s a lot of talk lately about [traditional] financial institutions taking interest in DeFi, but it’s hard to imagine major institutions participating in DeFi unless they’re confident it can be compatible with sanctions requirements.” DeFi projects are “decentralized, disintermediated and borderless — everything our legal and regulatory frameworks are not,” Ferreira informs Magazine. The latter are built around centralized, intermediated and jurisdiction-based architecture. “Therefore, this is a challenge and a learning curve for regulators, and not all proposed solutions will be optimal,” Ferreira adds. The European Union is aware of the DeFi compliance challenge. Its recent Markets in Crypto-Assets (MiCA) regulatory proposal “will force DEXs to have legal entities in order to transact with EU citizens, effectively banning fully decentralized exchanges,” Jevans tells Magazine. He adds, “Many so-called DEXs have very centralized governance, venture capital investors and physical headquarters, causing the FATF to categorize them as VASPs.” Meeting compliance demands for digital service firms like BitPay and BitGo will require some effort. “Trying…